In the evolving landscape of automotive technology, electric vehicle EV startups like Tesla, Rivian, Nio, and Xpeng are leading the charge, while traditional carmakers like Jaguar Land Rover (JLR) and Toyota face hurdles in the race to embrace a software-first approach. As software increasingly defines vehicle innovation, the gap between younger EV makers and established brands continues to widen.

EV Startups: Pioneers in Software-Driven Vehicles

The automotive industry is moving toward a software-centric future, where vehicles are no longer just mechanical machines but high-tech platforms. According to the 2024 Gartner Digital Automaker Index, Tesla remains a frontrunner, although it has seen a slight decline in its overall score, falling by 4% compared to 2023. Despite this dip, Tesla’s commitment to integrating software into its vehicles gives it a competitive edge. One of the standout features is Tesla’s ability to generate revenue from over-the-air software updates, allowing it to deliver new features and improvements without the need for physical changes to its vehicles.

However, even Tesla faces challenges. It has yet to adopt cutting-edge connectivity options like 5G or satellite-based communication, which has caused its lead to slip slightly. In addition, internal leadership changes at Tesla have sparked concerns about the company’s long-term direction. Frequent executive departures may be a sign of instability, though it’s still too early to predict how these shifts will affect Tesla’s trajectory.

The Rise of Rivian and Chinese EV Makers

While Tesla’s dominance remains intact, other automakers are catching up fast. Nio and Xpeng from China, along with Rivian from the U.S., have made significant strides in recent years. Rivian, for instance, has earned praise for its use of a zonal electronics architecture, which enhances efficiency and control. This advancement is crucial for the next generation of EVs, allowing manufacturers to push the boundaries of what their vehicles can do.

Nio improved its score in the Gartner index by 2%, while Xpeng and Rivian saw a 13% increase, thanks to their forward-thinking approaches to integrating software and hardware in their vehicles. Rivian’s refreshed R1T pickup and R1S SUV, equipped with the company’s advanced computing architecture, demonstrate how automakers can leverage software to boost performance and efficiency.

Legacy Automakers Face Major Challenges

Jaguar Land Rover: Falling Behind

In contrast to the rapid advancements made by EV startups, legacy automakers are finding it difficult to adapt. Jaguar Land Rover (JLR) continues to rank at the bottom of the Gartner index, indicating the brand’s struggles to keep up in the software-driven race. The report cites numerous areas where JLR needs to improve, including leadership’s understanding of technology, outdated vehicle architecture, and insufficient investment in autonomous driving and electrification.

JLR’s leadership has been slow to prioritize software innovation, a significant disadvantage in an industry where technology is quickly becoming the cornerstone of success. Without a strong focus on software, JLR risks falling further behind as competitors push ahead with more advanced, tech-savvy vehicles.

Toyota’s Decline:

Another surprising result from the Gartner report is Toyota’s drop in the rankings. Once a dominant player in automotive innovation, Toyota now finds itself struggling to keep pace in the software arena, with its ranking falling 7% compared to 2023. One of the reasons for this decline is the restructuring of its leadership. The head of Toyota’s vehicle software division no longer reports directly to the CEO, a move that has raised concerns about the company’s commitment to the digital transformation required to remain competitive.

Toyota, known for its efficiency in manufacturing and engineering, has been slower to adopt a tech-centric approach. As the automotive landscape shifts toward autonomous driving, electrification, and connected vehicles, Toyota will need to rethink its strategy and place a greater emphasis on software development to regain its footing.

The Path to Digital Transformation

For legacy automakers to succeed in this new era, they must undergo a fundamental transformation, not just in their vehicles but in their corporate culture. The traditional hierarchy of automotive companies often prioritizes hardware and short-term profits, which puts them at a disadvantage when compared to startups that were built with a tech-first mentality.

Culture Shift and Leadership;

Many of the CEOs leading successful EV startups come from tech backgrounds, which gives them an edge when navigating complex software challenges. In contrast, leaders of legacy automakers often lack this expertise, resulting in slower decision-making when it comes to technical issues. Additionally, software divisions at many traditional automakers are not given the attention they need, often being led by executives who are not part of the company’s core leadership team.

To stay competitive, traditional automakers must shift their focus toward attracting and retaining top tech talent. This includes offering competitive salaries that rival those of Silicon Valley tech firms, as many software engineers at legacy automakers are underpaid compared to their counterparts in the tech industry. Without addressing these gaps, legacy automakers risk losing their best talent to newer, more dynamic competitors.

Overcoming Resistance to Change:

The cultural shift required to embrace a software-first approach is not easy. Resistance often comes from within, especially from board members and executives who come from traditional automotive backgrounds. Shareholders looking for immediate returns may also be hesitant to support the long-term investment needed for a successful digital transformation.

However, the stakes are too high to ignore. As EV startups continue to innovate and dominate the market, legacy automakers face an existential threat. If they do not act quickly to prioritize software, they risk being left behind in an industry that is rapidly moving away from hardware-driven models.

The Global Landscape: U.S. vs. China

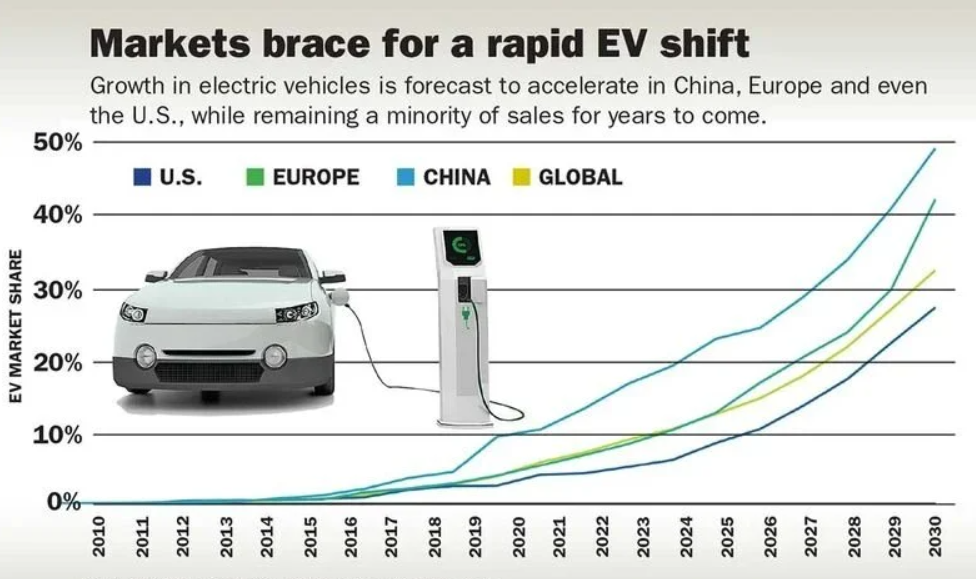

Geographically, U.S. automakers, led by Tesla, are slightly ahead in the race to become software-first companies. However, Chinese automakers are quickly catching up. Nio, Xpeng, and BYD have all made significant strides in the last few years, and China is emerging as a serious contender in the global EV market.

European automakers, on the other hand, are lagging behind, while Japan, once a leader in automotive innovation, has seen its performance deteriorate. The Gartner index highlights the urgent need for these regions to step up their game if they want to remain competitive in the global automotive landscape.